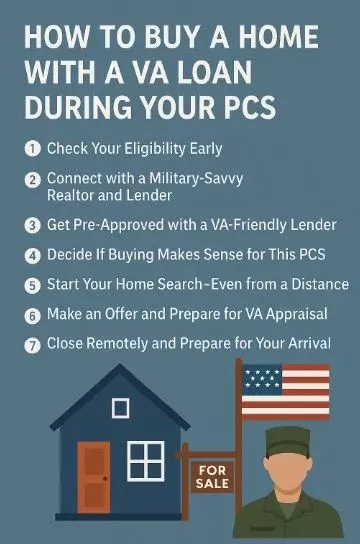

How to Buy a Home with a VA Loan During Your PCS

Relocating due to a Permanent Change of Station (PCS) is a fact of life for military families—but that doesn’t mean it has to be stressful. One of the biggest benefits of military service is your access to the VA home loan, which can make buying a home during your PCS easier, more affordable, and more secure.

Relocating due to a Permanent Change of Station (PCS) is a fact of life for military families—but that doesn’t mean it has to be stressful. One of the biggest benefits of military service is your access to the VA home loan, which can make buying a home during your PCS easier, more affordable, and more secure.

Whether you're headed to San Antonio, Killeen, Fort Hood, or another Texas military hub, this guide will walk you through how to buy a home with a VA loan during your PCS—step by step.

🇺🇸 What Is a VA Loan and Why Should You Use It?

The VA loan is a government-backed mortgage available to eligible service members, veterans, and some surviving spouses. Here's what makes it so powerful:

-

$0 down payment required

-

No private mortgage insurance (PMI)

-

Competitive interest rates

-

Easier credit and income requirements

-

You can reuse it—not a one-time benefit

Especially during a PCS, where housing markets are competitive and timelines are tight, VA loans give you more buying power and flexibility than most conventional options.

🪖 Step-by-Step: Buying a Home with a VA Loan During PCS

1. Check Your Eligibility Early

Most active-duty military qualify for a VA loan after 90 continuous days of service. Veterans, Reservists, and National Guard may also qualify with different service thresholds.

👉 Apply for your Certificate of Eligibility (COE) through the VA portal or ask your lender to request it for you.

2. Connect with a Military-Savvy Realtor and Lender

Not all real estate agents or lenders understand the urgency and nuance of PCS timelines. Find professionals who:

-

Know the local base housing situation

-

Are experienced with VA loan requirements

-

Can help with remote home buying if you're not in town yet

As a military-focused Realtor, I regularly work with clients PCSing into and out of Texas and can help coordinate everything remotely if needed.

3. Get Pre-Approved with a VA-Friendly Lender

Pre-approval gives you clarity on what you can afford and strengthens your offer. With a VA loan, the lender will look at:

-

Your credit score (usually 620+)

-

Your debt-to-income ratio

-

Your residual income (a VA-specific requirement)

-

Your COE and service history

4. Decide If Buying Makes Sense for This PCS

Ask yourself:

-

Will you be stationed here for at least 2-3 years?

-

Could the home work as a rental later if you move again?

-

Is the local market stable and growing?

In many Texas cities, buying is cheaper than renting long term—and you can build equity while you serve.

5. Start Your Home Search—Even from a Distance

With tight PCS schedules, you may need to:

-

Tour homes virtually

-

Make an offer sight-unseen (totally normal for military buyers)

-

Coordinate inspections and appraisals remotely

Your agent should walk you through every step and advocate on your behalf, even if you’re halfway across the country.

6. Make an Offer and Prepare for VA Appraisal

VA loans require a VA appraisal, which ensures the property meets minimum property requirements (MPRs). These aren’t just about value—they ensure the home is safe and livable.

Pro Tip: Avoid homes with extensive repairs or fixer-uppers unless you’re using a VA renovation loan.

7. Close Remotely and Prepare for Your Arrival

Closing can be done remotely in most cases, and funds can be wired. Many PCS buyers have their keys waiting when they land. You’ll just need:

-

A valid government ID

-

Orders showing your PCS

-

Your final loan documents and disclosures

💡 Common PCS + VA Loan Questions

Can I buy before I arrive?

Yes—many service members buy remotely and move in upon arrival. Virtual tours and remote closings make this easier than ever.

Can I use my BAH to qualify?

Yes! Basic Allowance for Housing (BAH) can be included in your income for loan qualification.

Can I use a VA loan if I already own a home?

Yes—you can use your benefit more than once, though entitlement limits and occupancy rules apply.

🏡 Final Thought: VA Loans Were Built for Moments Like This

Buying a home with a VA loan during PCS may sound complex—but it’s entirely doable, especially when you have a trusted team who knows the military lifestyle.

As a Realtor who works with military families across Texas, I’d be honored to help make your next move your smoothest and most stress-free one yet.