Why Buying Beats Renting for Military Families in Texas

When you receive PCS orders, the default move often feels like renting. It’s fast, it’s easy, and you don’t have to think about long-term commitment. But for military families relocating to Texas, buying a home—especially with a VA loan—often makes more sense financially and practically.

Here’s why buying beats renting in today’s Texas housing market for military families.

🏡 1. No Down Payment Needed with a VA Loan

One of the biggest obstacles to buying is the down payment. But with a VA loan, you can purchase a home with $0 down and no PMI (private mortgage insurance)—saving you thousands compared to a conventional mortgage.

Example: A $300,000 home with a conventional loan might require $15,000+ down. With a VA loan? Zero.

💸 2. BAH Covers Your Mortgage—Not Your Landlord’s

Your Basic Allowance for Housing (BAH) can go toward your monthly mortgage payment, building equity in your name instead of helping your landlord pay off their property.

Over a 3-year PCS cycle, that’s potentially $75,000–$100,000 in rent you could have invested in your own future.

📈 3. Texas Markets Have Strong Appreciation

Texas military towns like San Antonio, Killeen, and El Paso have seen steady home appreciation, making them excellent choices for buying—even short-term.

If you get stationed elsewhere, you may be able to rent out the home and keep earning equity. Many military families use this method to build long-term real estate portfolios.

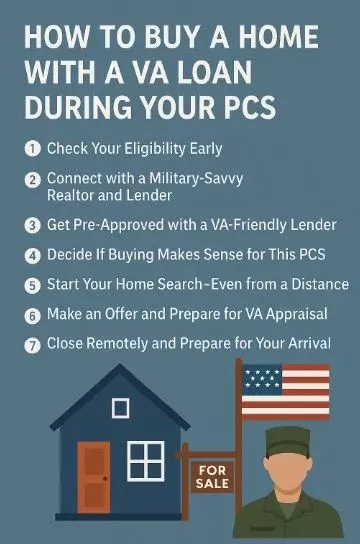

🔄 4. PCS-Friendly Purchase Options Make It Easier

Today, real estate professionals specializing in military moves can offer:

-

Virtual home tours

-

Remote closings

-

VA loan guidance

-

Shorter contract timelines

With the right team, you can buy remotely, move in as soon as you arrive, and avoid scrambling for base housing or temporary rentals.

🔐 5. Ownership = Stability, Customization, and Tax Benefits

Owning a home means:

-

No surprise rent hikes

-

Control over upgrades and changes

-

Potential tax deductions for interest and property taxes

It’s a sense of control and comfort—even during a hectic PCS.

🪖 Real Talk: When Buying May Not Be Right

Buying isn’t perfect for every PCS. Consider renting if:

-

You’ll only be stationed in Texas for <2 years

-

You’re unsure of your financial stability or career path

-

You’re relocating with very short notice and no time for house hunting

✅ Final Takeaway: Explore All Options, But Don’t Dismiss Buying

Many military families assume buying isn’t realistic—but with the VA loan and today’s tools, it’s more achievable than ever.

Owning in Texas isn’t just a home—it’s an investment, a tax benefit, and a step toward financial independence during your military journey.

📞 Let’s Talk About Your Texas PCS

Want to compare renting vs. buying based on your BAH and orders? I help military families like yours evaluate all options and secure the best possible move.

🧰 Ask for your FREE Renting vs. Buying Military Comparison Guide